Applying for financial aid can be daunting, but breaking it down into steps can make the process more streamlined and organized. Here is a simplified guide to help navigate the financial aid process and get the support needed to go to college.

Step 1: Complete the FAFSA and Retain Your Login Information

Step one in applying for financial aid is to complete the FAFSA, or the Free Application for Federal Student Aid. To begin, take a few minutes to view a helpful walkthrough by Karen Cooper, Director of Financial Aid at Stanford University, on Khan Academy. This will give you an overview of the entire FAFSA process.

All the necessary tax returns, W-2 forms, and all records of untaxed income should be collected before you start filling out the FAFSA. This can help make the entire process quick and smooth.

The IRS DRT is one of the best available features when it comes to completing the FAFSA form. The tool automatically transfers your tax information to your application form. The key reason for considering the DRT is that it is the fastest and most accurate means of inputting your tax data, making it easier and reducing the likelihood of mistakes.

Step 2: Complete the CSS Profile (If Necessary).

In addition to the FAFSA, some colleges and universities will require you to complete the CSS Profile, another financial aid application form used by some colleges and universities, although mostly private institutions. The CSS Profile requests much more detailed information about your family’s assets than the FAFSA, such as cars, second mortgages, or home equity loans.

As with the FAFSA, make sure you have all the documents ready before you complete the CSS Profile. If your family has special circumstances (such as a job loss or medical expenses), the CSS Profile contains a section where you can explain these to the schools you are applying to.

Step 3: Additional Paperwork After Submitting the FAFSA and CSS Profile

After you have submitted both forms, let it sit for about a week and then check with the colleges you applied to. Some will require more documents or paperwork. This is different from school to school, so it is a good idea to stay on top of requests to avoid delays.

Step 4: Review Your Financial Aid Award Letters

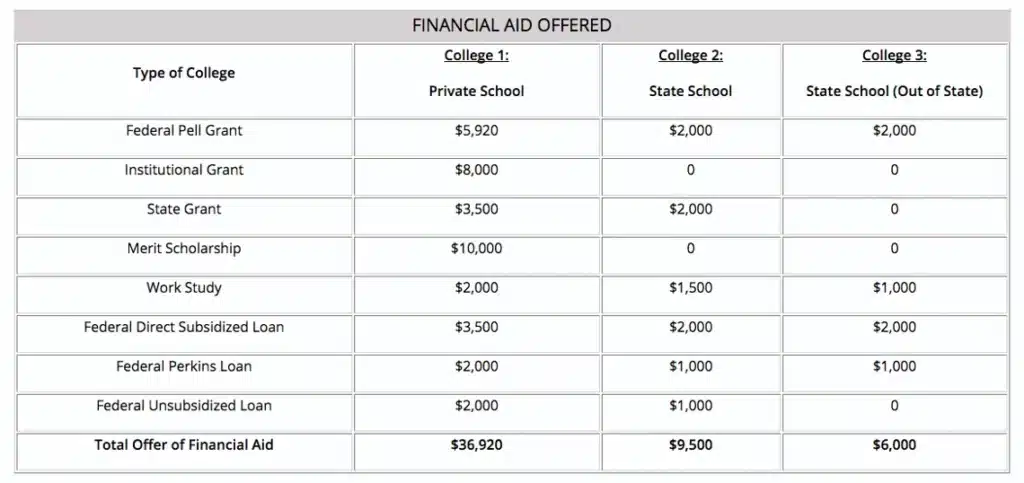

Once you’ve been accepted to a college, you’ll receive a Financial Aid Award Letter. This letter outlines the financial aid package each school is offering you, which may include grants, scholarships, work-study opportunities, and loans. It’s important to compare the offers carefully.

It’s also not uncommon for people to feel hesitant to contact the financial aid office at any given school with questions or for clarification about an award. Reach out and have a conversation about the process-it’s okay.

How The Financial Aid Process Works

Understanding Your Expected Family Contribution (EFC) and Student Aid Index (SAI)

When you finish the FAFSA, the government calculates your Student Aid Index, which is the new name for the Expected Family Contribution. This number is how much your family can afford to pay toward your education, based on the financial information you provided.

However, keep in mind that the SAI is not what you will actually pay for college-it is a baseline that colleges will use to develop your financial aid package. Approximately five days after you have submitted the FAFSA, you will receive a Student Aid Report (SAR). Your SAI and your Data Release Number (DRN) will be included on the SAR, and this number will be crucial if you must correct your FAFSA. Hold a copy of your SAR for personal reference.

Difference Between Federal Method and Institutional Method

Some schools, especially those that are not public, need the CSS Profile in addition to the FAFSA. Their SAI calculation will be the Institutional Method of calculation. These schools use detailed financial information different from the general Federal Method method used by public universities.

The FM is used to determine eligibility for federal aid, such as Pell Grants. Colleges use the IM to calculate their own financial aid, like grants or institutional scholarships. Because these methods can sometimes produce different SAI numbers, be prepared for variations in how different schools evaluate your financial situation.

What is Financial Need?

Your financial need is defined as the difference between a school’s COA and your SAI. A school’s COA is whatever it charges for tuition, room and board, books, and other personal expenses. It will be different from one school to another. However, your SAI is the same for all schools.

For instance, assume that a school’s COA is $40,000 and your SAI is $15,000. This means that your financial need is $25,000. Schools will use this number to determine how much financial aid they’ll offer.

Balances Owed After Financial Aid

Even if you receive financial aid, you may still have a balance to pay. This can include loans that need to be repaid or work-study wages you need to earn. Schools expect that the SAI represents what your family can afford to contribute, so the financial aid package is designed to help fill the gap.

Understanding Financial Aid Offers

Once your financial need is calculated, each school will send you a Financial Aid Award Letter. The amount of financial aid you’re offered may vary significantly by school. Some schools will offer substantial assistance, while others may offer minimal support. The award letter will outline the aid, including grants (which don’t need to be repaid), scholarships, work-study programs (which you’ll need to earn), and loans (which need to be repaid with interest).

Carefully review the letter and ask questions if you do not understand any part of the offer.

Important Financial Aid Deadlines

FAFSA and CSS Profile Deadlines

As such, submit your FAFSA and CSS Profile as soon as they become available in the fall, October 1st of every year. However, deadlines for the various colleges are different; many colleges have their financial aid deadlines in January and February, so check the individual school’s website to determine exact dates.

State-Specific FAFSA Deadlines

Each state may have its own deadline for FAFSA submission. Some states have deadlines as early as mid-January, so make sure to research the FAFSA deadline for your state on the U.S. Department of Education’s website or by checking with your state’s financial aid office.

Final Reminders

- Check deadlines every year: FAFSA and CSS Profile are typically available starting October 1st, but deadlines can vary. Some colleges require financial aid applications by mid-January, so apply early.

- Update financial aid offices: If your family experiences a significant change in financial circumstances (like losing a job), inform the financial aid offices immediately.

- Reapply annually: You’ll need to complete the FAFSA and CSS Profile every year to continue receiving financial aid.

- Apply early: Since many schools distribute financial aid on a first-come, first-served basis, the earlier you apply, the better your chances of receiving assistance.

By following these steps and staying on top of deadlines, you’ll be well on your way to securing the financial support you need to attend college.